Your inefficiencies are costing you. And you’d be surprised by how much.

We’re going to help you identify the biggest blind spots that event production companies like yours have. But understanding the problem is only half the battle. So, we’ll also show you how to fix them with a single tool, allowing you to capitalize on the right opportunities, maximize your dollars, and scale your business.

Table of Contents

Categorizing Your Costs

Opportunity Costs

Expenses

Liability Costs

Hidden Opportunity Costs: Lost Revenue and Missed Billing Opportunities

Hidden cost #1: Lost revenue

Hidden cost #2: Missed billing opportunities

Hidden Expenses: Costing You More Than You Realize

Hidden cost #3: Rounding

Hidden cost #4: Overtime

Hidden cost #5: Workers’ compensation

Hidden cost #6: Software applications

Hidden cost #7: Travel overages

Hidden cost #8: Additional labor coordinators

Hidden cost #9: Manual payroll and billing processes

Hidden cost #10: Logistics costs and mishaps

Hidden Liability Costs: The Risk of Non-Compliance and Failure to Centralize Your Talent Pool

Hidden cost #11: Penalties for misclassifying

Hidden cost #12: Penalties and wage claims for not correctly paying overtime

Hidden cost #13: Not maintaining ACA compliance

Hidden cost #14: Not complying with state and federal laws and tax filings

Hidden cost #15: Not housing your talent pool in a centralized place

One of the biggest shortfalls of the live events industry is how manual the processes are. You probably know someone who has a famous whiteboard where they keep track of their events, someone who still uses paper time sheets, or someone in the 40% of live event companies that still use spreadsheets to manage their projects.

When producing live events, time is money and (stating the obvious but necessary) money is money. Spending hours tracking down vendors, keeping up with multiple spreadsheets, or manually entering data is all time that could have been spent on other revenue-generating tasks. Missed billing opportunities, money spent on a multitude of tools when none seem to be quite what you need them to be, and exorbitant travel and logistics costs are all examples of opportunities to capture that money straight to your bottom line.

With an all-in-one solution, you can reduce that wasted time and money by automating manual processes and grunt work. This gives you more time to focus on strategically growing your business instead of constantly worrying about the workflow around your live events.

Because of their ability to increase efficiency, all-in-one solutions also help you chip away at cost of goods sold, leading to a stronger bottom line and higher valuation. Implementing such a system should be at the top of the list for event company founders and owners — especially those looking to exit in the near future.

{% video_player “embed_player” overrideable=False, type=’hsvideo2′, hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width=’1920′, height=’1080′, player_id=’116633563800′, style=” %}

LASSO founder, Clay Sifford, on the compounding effects of hidden costs

In this article, we look at:

- The different types of costs associated with running an event production business, and

- How an all-in-one platform can help you save both soft costs (time) and hard costs (good ol’ cash)

We can categorize all our costs down into three buckets: opportunity costs, expenses, and liability costs.

Categorizing Your Costs

Opportunity Costs

Opportunity costs are the potential benefits forgone in favor of other options. They’re not always tangible and can often be difficult to quantify.

↪ Example: Your crewing, travel, and payroll processes all live in separate systems. You know it would be a smart move to consolidate them — find a solution that contained all of those tools in one. But it’s not cheap, and your process is working well enough.

Now, let’s say you receive an RFP for a project that fits squarely within your company’s wheelhouse. You’ve done other events like this one before, but this one’s bigger and more complex in every way. Because you haven’t invested in the tools and resources you needed to scale and support an event of this nature, you either have to turn down the business and lose the revenue or choose to take a major hit on your margin. Neither are ideal outcomes.

It’s critical to consider the value of the alternatives you’re not choosing to make the best decision for your business and its growth.

Expenses

Expenses include any money spent on goods or services used by the company.

↪ Examples: Labor, staff salaries, logistics, travel, equipment, rent, sales and marketing spend, etc.

It’s important to track all expenses so that you can make informed decisions about how best to allocate resources within your organization.

Liability Costs

Liability costs relate to the areas of your business where you are exposed and at risk to pay penalties, fines, legal fees, etc.

↪ Examples: Your company works in a state that imposes penalties for missed meal breaks, your lack of safety initiatives exposes you to workers comp claims, or the dreaded misclassification audit imposes significant penalties for not paying your employees’ taxes as their employer.

Now that we’ve set the stage for your business’s costs into these three buckets, let’s start pulling back the curtain on what’s really costing you.

Hidden Opportunity Costs: Lost Revenue and Missed Billing Opportunities

The two main types of opportunity costs for event companies are lost revenue and missed billing opportunities.

Lost revenue — refers to potential business that was not obtained because an event company lacked the necessary resources to handle it.

Missed billing — refers to the services rendered that weren’t billed because they were overlooked, or not documented or tracked effectively making it hard to go back to the client. This could also include when crew members that don’t show, making them unbillable.

Hidden cost #1: Lost revenue

Many event companies can barely support the opportunities they have and are forced to say no to new business. Or, they take new business at smaller margins because they don’t have the resources or tools to help them execute efficiently.

Does this sound familiar?

Resources are scarce and without good tools or talent, it’s hard to execute and meet the demand. With the right tools and access to a solid talent pool, you can execute on more events without carrying the overhead to do so.

Think about how much business you have to turn down a year. How much does that cost you? In other words, how much more could you be making?

The real-time data and insights delivered by an all-in-one platform can help you pinpoint and capitalize on these opportunities. By streamlining workforce management, project management, and inventory management under one tool, you can understand your true capacity for growth and make smarter decisions to increase that capacity.

You might like: How to Build a Revenue Engine

Hidden cost #2: Missed billing opportunities

So often, changes to show flow, rehearsal needs, and gear requirements occur both before and during the show.

Because of the rushed nature of events, and because we seek to please our clients above all else, change orders are often not captured and billed.

Without an all-in-one tool to easily log the full cost of these ad hoc updates and upgrades on the fly, you either:

-

- forget to document and bill the change order altogether, or

- let it slide because the time and effort to document and bill the change order after the fact isn’t worth the trouble.

Are you eating small costs that add up to big costs? Now think about that year over year.

There’s another huge benefit that an all-in-one platform can help you leverage. Modern event management platforms have built-in solutions for project management and team collaboration with your client. No more foregoing revenue because “it’s too late to go back to the client”.

Updates to the original scope of an event can be logged and flagged for follow up, ensuring it makes its way to the final project invoice.

Hidden Expenses: Costing You More Than You Realize

Expenses are part of doing business. The tricky part is identifying the hidden expenses are that you can’t see that compound, resulting in huge, unforeseen costs.

This is especially true in the event industry where the sheer volume of labor, travel, and complex pay rules can easily obscure expenses you hadn’t accounted for.

For example, chances are high you’re overpaying on your workers’ comp. Often, crew don’t work their full minimums, but unless you have reporting around that, you’re most likely overpaying. And let’s face it, workers comp in our industry isn’t cheap.

What hidden expenses do you have? Well, if you knew, they wouldn’t be hidden, would they?

So instead, we’re going to shine the spotlight on them for you.

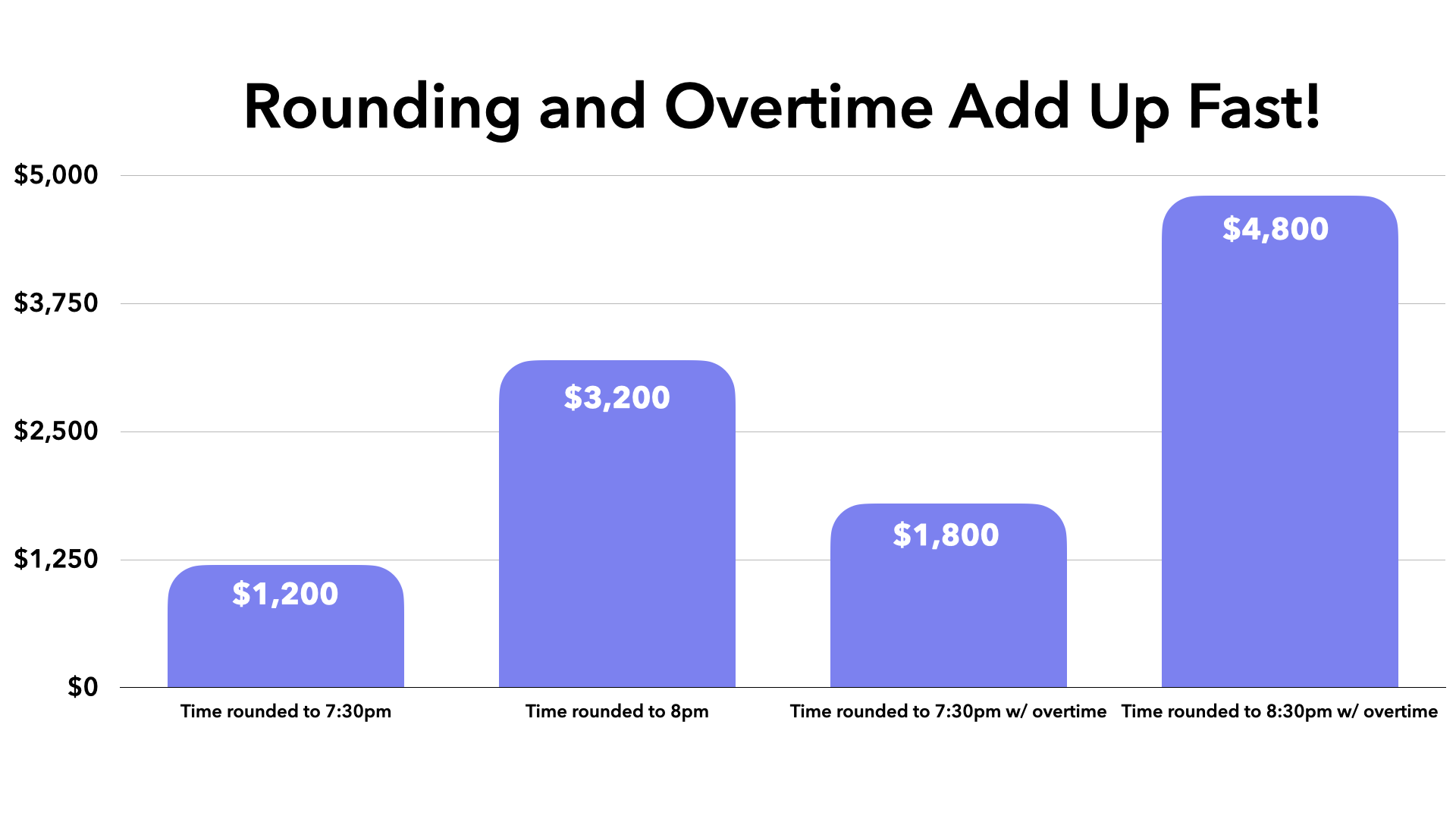

Hidden cost #3: Rounding

Without automated time capture systems in place, many companies resort to rounding time. Employees may be paid for more hours than they’ve actually worked, resulting in inaccurate wages and additional payroll costs.

↪ Example, In-House Talent: Let’s consider a scenario where you have a five-day job and require 20 techs, each with an hourly rate of $40.

Let’s say the job ends each day at 7:12 PM. If rounding, your employees will “clock out” at either 7:30 PM or 8:00 PM.

If you round until 7:30 PM, you will pay an additional 18 minutes for each of the 20 employees for all five days, which amounts to $1,200 of time not actually worked.

Now let’s say you round up to the next hour. So, if the job ended at 7:12 PM and you round up to 8:00 PM, then you will pay over $3,200 for time not actually worked.

This doesn’t even take into account what you owe for workers’ comp on this rounded time — time you weren’t actually exposed to any risk. (Skip to Hidden cost #5: Workers’ compensation for more.)

↪ Example, Outsourced Talent: Let’s consider a scenario where you have a five-day job and require 20 techs. You are being charged $40 per hour for straight time.

Let’s say the job ends each day at 7:12 PM. If rounding, the labor company will charge you until either 7:30 PM or (most often) 8:00 PM.

If you are being charged until 7:30 PM, you will pay an additional 18 minutes for each of the 20 workers, which amounts to $1,200 for five days of work.

Now let’s say the company rounds up to the next hour, which is a common practice. So, if the job ended at 7:12 PM and they round up to 8:00 PM, then you will pay over $3,200 for those five days of work.

Reminder: Both of these scenarios cover just one show. How many shows do you do each year?

Again, when you outsource labor to an agency, rounding forces you pay for time that wasn’t worked, and delivers no extra benefits to your company or event.

Imagine if that didn’t have to be the case. Just think of the money you could save on every worker for every event.

Hidden cost #4: Overtime

Without a tool that can both schedule crew and track their time, you have no way of seeing who is approaching overtime. This makes it very difficult to:

-

- Predict overtime expenses

- Manage overtime hours in the field with your client and your crew

Let’s expand on our rounding scenario above and assume your hourly cost for overtime is $60 per hour.

If those same 20 techs already worked more than 10 hours that day, and your labor company rounds to the half hour, you will pay an additional $1,800 for time that wasn’t worked.

And if your labor company rounds to the next hour, you will overpay by $4,800 for no extra work or benefit.

It adds up fast!

Hidden cost #5: Workers’ compensation

Workers’ compensation insurance covers injuries to crew while on the job. It is calculated as a percentage of payroll. And it’s done this way because payroll is an indicator of the crews’ level of risk (i.e., hours on the job.)

In the live events business, most positions have minimums. For example, crew might be asked to work a show where they are only needed for 3 hours, to make it worth driving in, that position might guarantee 5 hours of pay.

Most companies pay workers comp on the entire 5 hours instead of the actual exposure, which is 3 hours. Reporting event hours worked vs. hours paid can make a big difference in calculating these actual costs that add up very quickly.

✍️ Pro tip: Make sure you’re coded correctly. Incorrect coding is another massive area of overspending unnecessarily. (The code for most event crew in most states is 9154. Be sure you work with your agent to confirm and correct if necessary.)

Hidden cost #6: Software applications

Event companies typically have a tool for every step in the workflow — and a cost to license each of them. Case in point: in a 2022 survey, we found that 25% of event companies use 4+ tools for project management purposes alone.

Tool consolidation — finding one piece of software that can be adopted by multiple departments for many functions — is not only an enormous opportunity for cost savings, but also a more effective way to distribute information company-wide. Said differently, a single source of truth can prevent costly confusion, receptive work, and delays.

Hidden cost #7: Travel overages

Why travel a tech to an event when there are hundreds of perfectly good techs already living in that market? Of course, you may not know those hundreds, but there are easy ways to get connected to local event talent. And if you do still need to travel your lead in, why pay top dollar on travel expenses?

The best all-in-one event production tools offer the following three features to keep travel costs low:

- The ability to see the true cost of travel before you book that person. Often there are major variances. For example, it could be $500 less expensive to travel crew from Atlanta than Orlando.

- Negotiated travel rates and booking, in-platform. Not only should you be able to pay group rates for your crew, you should be able to book and communicate trip details to your travelers in bulk.

- A talent pool of local labor and top techs in all the major markets. It should be easy to find quality crew, with competitive rates and top-notch skills, who are already in the city where you’re having your event.

Calculate how much you’re overspending on crew travel

Hidden cost #8: Additional labor coordinators

Many times, event companies default to hiring more staff to offset the inefficiencies in their processes or their lack of automation. They think the only way to grow is to throw more people at the problem. But the overhead cost of this thinking is enormous.

The right people plus the right software to automate manual, repetitive event tasks is a much more efficient approach. It also allows your team to be more operational and strategic rather than administrative and tactical. For instance, instead of constantly emailing and calling to schedule crew, your team can reallocate that time to recruiting, training, and engaging with your crew, which is far more valuable and yields a much higher return.

You might like: How Dupree Security Saves $60k a Year in Labor Coordination

Hidden cost #9: Manual payroll and billing processes

Do you have a clunky, labor-intensive workflow to process payroll? Have you entertained the idea of hiring additional accountants or back office employees so you can invoice faster for cash flow?

Typically, this is because you lack the following:

-

- A tool that tracks hours worked in real time and integrates with payroll

- A payroll partner that understands the events industry and all of its nuances

- A way to automate the calculation of complicated pay rules

If you can’t track time fast, you can’t invoice fast, which means you can’t get paid fast, which negatively impacts cash flow.

When evaluating all-in-one event production tools, look for one that enables the three points listed above to automate payroll, expedite invoicing, and increase cash flow.

Related: 4 Signs It’s Time to Update Your Event Payroll Software

Hidden cost #10: Logistics costs and mishaps

Late gear deliveries to an event site wastes precious minutes — minutes you are paying for your crew to stand around and wait. Imagine you have 30 crew members with nothing to do for two hours because the truck is late. 30 crew x 2 hours x $40/hour = $2,400 — just for that one late truck. And it’s safe to assume this happens throughout the year.

Individual event companies also don’t have the buying power to command competitive shipping rates. They’re often at the mercy of big-name transportation companies that are unwilling to negotiate on a case-by-case basis.

Event companies should be able to take advantage of competitive trucking rates, know the true cost of late deliveries, and have real-time insight into actual delivery times. This is something the top event production platforms enable. Tools with booking and negotiated transportation rates built-in are a huge plus and gives your team the peace and confidence they deserve in the field.

Hidden Liability Costs: The Risk of Non-Compliance and Failure to Centralize Your Talent Pool

Minimizing the risks associated with your event company is paramount. There are two areas event company owners need to familiarize themselves with here: compliance and talent documentation.

Hidden cost #11: Penalties for misclassifying

If audited for employee misclassification (categorizing crew as independent contractors rather than employees), the fines are steep — enough to put your business under. Event company owners need to make sure they’re following the correct protocols and regulations for hiring crew members, as well as ensuring everyone on staff is properly onboarded with the correct tax documents, licenses, and insurance.

It’s no longer OK to say, “That’s how our industry does it,” because it’s not. Unlike a decade ago, most event companies are now issuing W-2s instead of 1099s.

To be clear, just because someone has an LLC and carries their own insurance does not qualify them to be a 1099 in the eyes of state or federal laws.

Hidden cost #12: Penalties and wage claims for not correctly paying overtime

If your company is issuing 1099s instead of W-2s, there is much greater room for error when it comes to paying overtime. This is because 1099s are not subject to additional time and a half or double time pay associated with overtime. Conversely, W-2s come with much more stringent overtime requirements that must be met for all eligible employees.

{% video_player “embed_player” overrideable=False, type=’hsvideo2′, hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width=’1280′, height=’720′, player_id=’118363288207′, style=” %}

Hidden cost #13: Not maintaining ACA compliance

Under the Affordable Care Act, employees are entitled to benefits when they work an average of 30+ hours a week for a single company. Many event companies use the same people over and over but do not take the step to provide benefits for their freelancers, which put them at risk for fines and penalties.

It is important to consider how these ACA compliance regulations affect your business, as well as any applicable overtime rules in order to avoid costly mistakes. Investing in an all-in-one tool built specifically for the events industry can help manage your exposure to these additional costs, putting you in the driver’s seat instead of being surprised with unplanned costs.

Taking this step can save you time and money in the long run by protecting both you and your company from expensive fines. And also provides a better work experience for your employees.

Hidden cost #14: Not complying with state and federal laws and tax filings

Many event companies have employees in multiple states, which means they must file taxes in each of those states, both quarterly and annually (940s and 941s). It also multiplies the number of state regulations regarding sick leave and overtime you have to comply with.

In California, for example, an employee is entitled to one day of sick leave for every 30 hours worked. Who in your company is tracking this? Enforcing this? Now multiply this complexity by every state in which you operate.

Failure to know and abide by these state laws and regulations can result in penalties and fines, as well as a difficult work environment for your crew. Streamlining your scheduling and payroll with software that can calculate and automate them is like an insurance policy — an investment made to protect the future of your company.

There are also Employer of Record (EOR) solutions that outsource that liability for a fraction of the cost. This is a smart option when an event company knows which crew members they want on an event, but outsources payroll to a third party. This third party essentially becomes the crew member’s employer, marking up their rate to cover taxes, Workers’ Compensation, etc.

Hidden cost #15: Not housing your talent pool in a centralized place

Where do you keep all of your crew’s contact information? How are you keeping track of who does what, who can run what equipment, their market, their rates, etc.? Often, event companies house this in a spreadsheet that could be corrupted or deleted at any time. Or worse, inside the contacts app of your labor coordinator’s cell phone. What would you do if they walked out the door tomorrow?

As an owner, you need to protect the pool of talent your company has built. Your talent is what sets your company apart. But you can’t be confident of your roster’s safety if it’s not housed in a centralized place, accessible to everyone that needs it.

Storing your crew contact information in a centralized, all-in-one platform for event production doesn’t just eliminate the risk of loss, it also speeds up the scheduling and confirming process. The best tools will allow you to schedule and confirm your roster in bulk.

An all-in-one event production platform: the new competitive advantage

As an event company owner, modern software made specifically for the event industry is an investment you can’t afford not to make — especially with the demand for events at an all-time high, and the supply of top event talent at an all-time low.

At the very least, it can help you shine a light on these hidden costs. Being aware of them and their impact on your business is the hardest part. And at best, it can help you become proactive in avoiding them. Which means you can be more competitive than you’ve ever been, lapping those companies that choose to struggle with multiple, disparate tools, and completely leapfrogging the ones that stubbornly stick to manual processes.